Much has been said and written about the potential of blockchain in terms of reducing friction over transaction costs by omitting intermediaries. One way or another, a deeper application of blockchain has emerged. This is about the tokenization of the economy, which is largely related to the recent boom in initial coin offerings (ICOs).

Definition

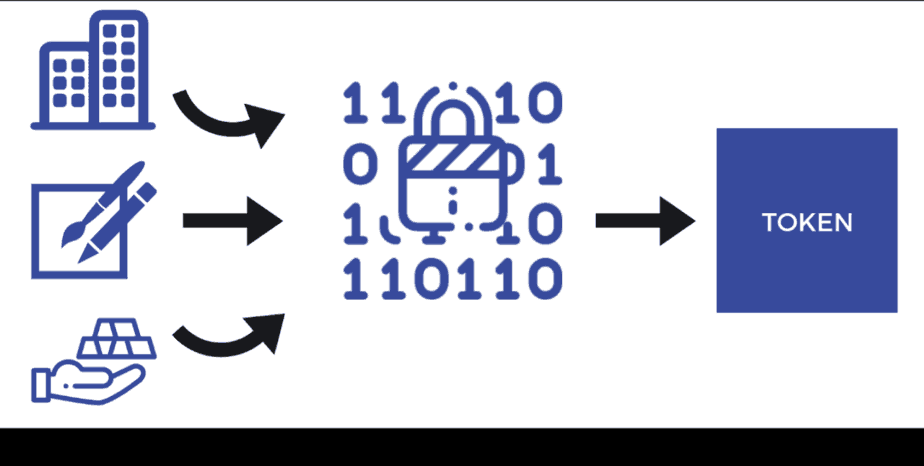

In a recent interview with Don Tapscott, CEO of Blockchain Research Institute, CEO of CitizenHex Benjamin Roberts, he gave a good assessment of the token economy. Blockchain is known as the Internet of Value. There are several blockchain-based digital currencies, which implies an immutable and transparent way of transferring them and assigning their owners. These digital currencies or tokens can be used to represent properties of objects and properties of the real world outside the blockchain. This is what we mean when we talk about the tokenization of goods and the real economy.

Tokenization technology

For tokenization to work, some kind of centralized infrastructure or institution must connect tokens in the blockchain with real world objects. Typically, a number of professional organizations are involved, including computer and technology, appraisal firms, insurance companies, trustees and law firms. Together, these organizations test, certify, condition, insure and evaluate. Once this process is successful, the product can be added to the blockchain, where interested investors can place a bet on how many shares of the product they want to buy and at what price.

Brainstorming DigiShares Platform

DigiShares provides a white label platform for digitizing securities (stocks, bonds, etc.), issuing them in order to raise funds for a project and long-term management of a group of tokenized investors. The DigiShares platform can be used for any type of fundraising (STO), but as a company DigiShares focuses on real estate projects. This document is also about this industry.

Tokenization can revolutionize the real economy. On the one hand, it can improve the liquidity and transparency of high-value properties such as luxury real estate or famous works of art. The owners of this property can also finance themselves by partially tokenizing their assets. On the other hand, it will democratize access to these investment opportunities, which have traditionally been available only to investors with high net worth.

Tokenization in progress

Recently, ICOs have begun to focus on tokenizing the real economy. One of them is called the Patron; This is a new online art marketplace that offers art lovers the opportunity to buy stocks of famous paintings. The name “Patron” comes from Guy Metzenas, an art collector from Ancient Rome who democratized art by funding poor poets. By purchasing ART tokens, investors can buy and exchange shares of masterpieces (such as Monet or Picasso) that are traded on the Mecenas exchange. The platform has enormous potential to significantly increase the liquidity of the entire art market, as well as to democratize it.

LAToken

Another example is the assets of a token platform called LAToken. The main currency for trading assets on this platform is called LAT. By purchasing LAT, its owners get access to an expanded range of tokenized assets. These assets include stocks in Apple, Amazon, Tesla and commodities such as oil, silver and gold. More access to real estate and art.

According to a study by LAToken, the total cryptocurrency capitalization could surpass $ 5 trillion in 2025. 80% of these, that is, $ 4 trillion, can be cryptocurrencies hosted in real-world assets (for example, stocks, real estate and works of art). The trading volume of these cryptocurrencies can exceed their market capitalization by more than ten times. That is, by 2025, the volume of transactions may amount to $ 40 trillion.

All of this means that the opportunity for growth that the tokenization of the real economy offers is indeed significant. Holders of liquid and high-value assets – stocks, debts, real estate, and art – will be able to unlock value and be able to tokenize those assets on the blockchain. Ordinary investors will have access to these assets or commodities through these terms. Soon, tokenization will penetrate all corners of the real economy.