Leonardo of Pisa, aka the mathematician “Fibonacci”, posted his Fibonacci series in 1202. Fibonacci got here upon his now very well-known series of numbers while he turned into looking to breed rabbits and determine out what number of pairs of rabbits he could have on the cease of 12 months primarily based totally upon their breeding conduct. This is simply the sort of no-nonsense method that the Forex market buyers are into.

https://www.scifair.org/algebra/FibonacciSeries.aspx

While many consider the Fibonacci series as a mathematical abstraction, it’s far grounded in an actual global application. The Fibonacci series may be used to expect styles that could now no longer in any other case be apparent.

So how is the Fibonacci series relevant to foreign money investing? Savvy traders recognize that there are styles to the moves of the inventory and foreign money markets which may be visible with the aid of using reading beyond the conduct of traders. The marketplace truisms “purchase low, promote excessively” is primarily based totally on the expertise of those marketplace styles.

Hidden styles of funding advertising can not be visible up close. There isn’t any correct feel in looking to expect the hourly or everyday fluctuations of funding markets. However, universal prolonged developments thoroughly may be. Increased earnings are taken benefit of while traders and the Forex market buyers expectantly use the range series of Fibonacci to attain their gains.

The Fibonacci series is a string of numbers with every range being the sum of the 2 numbers which preceded it. For example, one such string could be 1,1,2,3,5,8,13,21 and so on. These numbers are associated in numerous ways. Any given range in a Fibonacci series is set 1.618 of its predecessor – the “golden ratio” of the Greek mathematicians.

The maximum not unusual place packages of the Fibonacci series for funding functions are retracements and arcs.

A Fibonacci chart is made from 3 curved traces which constitute guide ranges, key resistance, and range. A trendline is first drawn among factors (commonly the excessive and coffee factors over a given length of time). Three curved traces are then drawn which intersect the trendline on the 38.2%, 50%, and 61.8% factors. Decisions approximately shopping for and promoting are made at those factors (i.e. – while the charge of the commodity in query reaches those factors).

Now, a retracement, in investing, refers to a reversal withinside the motion of an inventory’s charge–a reversal that is sufficient to counter the inventory’s triumphing trend. Advanced a hit traders pay excessive interest to retracement opportunities and styles. The Fibonacci retracement analyzes the chance that an economic asset’s charge will see a bigger than common retracement after which come to guide or resistance at the important thing Fibonacci ranges earlier than it then keeps on in its authentic direction. A trendline is drawn among intense factors; then, its vertical distance is split with the aid of using the important thing Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8%, and 100%.

Multitudes of excessive-stage buyers advantage with the Fibonacci retracement method. It aids them in locating the maximum strategic placement of transactions, their goal expenses, and stop-losses. Gartley styles, Tirone ranges, and the Elliott Wave idea are different technical gear that employs retracement.

The Fibonacci components honestly work and are beneficial whilst investing. the Forex market buyers global are locating it a hit whilst the usage of it.

Fibonacci Retracement

Many buyers use Fibonacci retracement ranges in making their access and go out selections for a trade. Traders use Fibonacci Retracement ranges to assist become aware of the fee guide and resistance. What is extra critical is how you operate Fibonacci Retracement ranges in distinctive buying and selling situations.

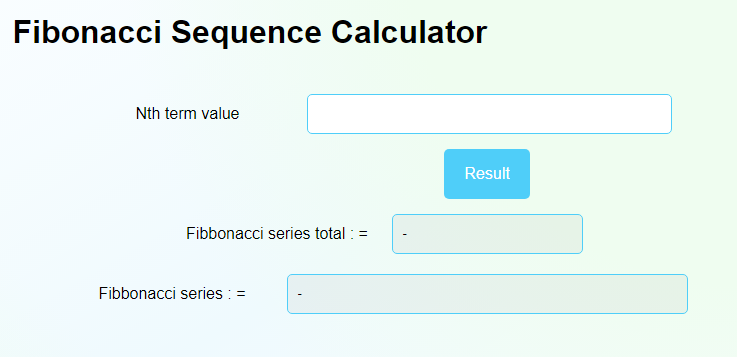

In order to apprehend Fibonacci retracement ranges, you need to realize something approximately the Fibonacci collection. The Fibonacci collection is derived via way of means of including the 2 intending numbers to locate the following wide variety withinside the collection. The first numbers are 0, 1 and after that, you could upload the 2 intending numbers to locate the following wide variety. So, the 1/3 wide variety could be 1, the fourth: 2, the fifth: 3, the sixth: five, and so on. The collection develops like this: 0,1,2,3,five,8,13,21,34,55,89,one hundred forty four,233,377,610,987,………..out to infinity.

There is a totally critical ratio acquired via way of means of dividing the better wide variety with the decrease one intending it withinside the collection above. Divide 233 via way of means of one hundred forty-four, you get 1.618. This ratio is referred to as the golden imply and could be very critical. The inverse of this ratio is 0.618. Another ratio this is critical is acquired via way of means of dividing any wide variety withinside the collection via way of means of wide variety better. So divide one hundred forty-four via way of means of 377, you purchased 0.381.

Traders use those numbers similarly to 0.0.five and 1 as Fibonacci retracement ranges. So the Fibonacci retracement ranges could be 0, 38.1%, 50%, 61.8% and 100%. Traders suppose that fee movement will have a tendency to locate guide or consolation at those ranges. It is any other query whether or not it does or now no longer. Most of the buyers use the wide variety of 38.1% as an access factor withinside the trending marketplace.

So you need to end up acquainted now no longer simplest with Fibonacci retracement ranges however additionally projections and extension in case you are actually critical in turning into a great trader. Now a critical query that involves thoughts is that does the marketplace believes in those numbers?

We all realize that markets are simply humans shopping for and selling. What the humans agree with, the markets agree with too. In different words, humans’ feelings and sentiments have plenty to do with figuring out the conduct of the marketplace. When humans are bullish, markets are bullish, and whilst the humans are bearish, markets are bearish. Therefore, whilst the majority of the buyers use Fibonacci retracement ranges of their buying and selling, markets begin believing in them!

Many buyers use retracement ranges in making their access and go out choices for a trade. Traders use Fibonacci Retracement ranges to assist perceive the fee assist and resistance. What is extra crucial is how you operate Fibonacci Retracement ranges in distinct buying and selling situations.