If you are contemplating starting a private equity firm, here’s good news for you. In this article, we will be discussing the prerequisites for entering the private equity industry, and what you are supposed to do to accomplish the same. PE is a dynamic industry wherein fund managers are highly adept at scoring wealthy clients, mostly institutional investors, family offices, and high-net-worth individuals. Attracting funds, and strategizing for the same is key to starting a PE firm.

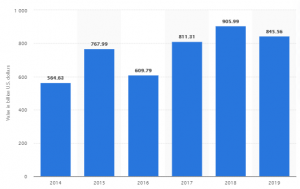

Value of worldwide private equity transactions amid 2014 & 2019 (in billion USD), Source: Statista

As per a Statista study, the value of global private equity transactions has skyrocketed from USD 564.63 billion in 2014 to a whopping USD 845.56 billion last year.

Get Familiar with the Potential Challenges

A majority of US private equity firms use stock to hold control in the private companies they buy. For individuals having a passion for the private equity industry, establishing their own PE firm should not be an unachievable task. However, to build a top private equity firm, one needs to understand the potential obstacles that may come in the form of roadblocks during their PE start-up journey. You need to be realistic about the intense competition that exists in the said industry.

Besides, breaking into the private equity sector demands intensive planning, research, and foresightedness. Moreover, the cost to start a PE firm is extensively high, thereby making it an overwhelmingly costly affair.

Basics of Setting up a PE Firm

Contrary to starting a hedge fund company, the private equity investment professionals who are interested in starting their own PE firm, usually don’t focus much on short-term monetary benefits achieved through buying & selling stocks and other kinds of assets in the financial markets. The best private equity firms strive to invest directly into private companies to later sell it at a much-hiked price than it was bought at.

In the simplest terms, a private equity firm would manage a large pool of funds sourced through their wealthy clients who have a lot of capital at their disposal to invest in the financial markets. These rich clients sourced by PE firm owners and other higher-management professionals at private equity firms, seek a profitable return to further increase their existing wealth.

The funds sourced from investors are managed by the fund manager who can be an individual or a group of individuals. The fund manager executes on the most apt investment strategy that can bring in the best ROI. Highly-skilled and experienced consultants are employed by the fund managers who assist in improving the logistical workflow.

How PE Firms Make Money?

The fund managers make their salaries by charging an operational fee to their clients, or the investors. Also, they get a predetermined percentage of profit the fund eventually succeeds to generate, which is basically a form of work incentive to them.

Starting a PE Company

The process is much similar to starting any other business. Firstly, you would need to focus on drafting a thorough business plan, including every single detail attached to the PE business. Later, try to attract funds from investors by showcasing your understanding of the business and the related markets before them. You must demonstrate your strategy on how you will go about generating profits, and what your exact investment strategy is. Basically, it’s about attracting wealthy investors, who will offer you the funds to invest in the private equity market.

At the end of the day, it’s your credentials and your knowledge about the financial markets that will help you persuade clients into handing over big sums of their money. And that’s what is your basic business requirement, the capital to invest in the markets.