Maintaining a good credit score is vital to get your loan or credit card sanctioned from the lender. However, most of the people are unaware about their credit score and apply for a credit card or loan. When the financial institutions decline their loan and credit card applications, they feel frustrated as they don’t know what to do about it particularly when they are in a dire need of funds. If your loan or credit card application has too been denied by a bank or a financial institution, then read further to know- how you can get a loan even with a low credit score.

What is Credit Score?

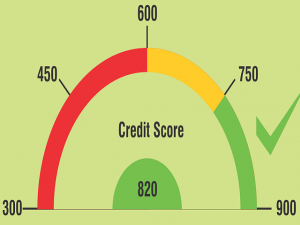

Credit score is the measurement of your creditworthiness. It is a number between 300-900, which depicts your creditworthiness. The closer your score is to 900 the greater are your chances of getting a loan approved. So, before applying for a loan be it car loan, personal loan or home loan, you should always check credit score to see the likelihood of getting your loan approved.

Keeping a tab on your credit score offers several advantages. Some of them are-

- You can always take timely measures to improve your credit score

- You can guess the probability of getting your loan and credit card application approved

- Helps you detect any error in your credit report and you can correct it on time

- Allows you to keep a tab on your financial identity

- Helps you known what has led to a low credit score

- Helps you know the loan and credit card offers available

A credit score usually greater than 750 is considered as good and it implies that you have responsibly managed all your credits. While a poor credit score i.e. less than 600 represents you as a risky borrower in the eyes of the lender. So, when you are applying for a loan, it is imperative to ensure you have a good credit score. With a good credit score you can also negotiate with the lender in terms of interest rate and loan tenure. In addition to your credit score, the lenders consider several other factors like, your income, type of loan, loan amount, age, past loans, etc. to decide whether to approve your loan application or not.

What is Good, Fair and Bad Credit Score?

According to the leading credit bureaus, there are not any specific numbers to determine whether a credit score is good or bad, but most of the lenders classifies the credit score as follows-

650-700 – Poor

700-750 – Fair

750- 800 – Good

800+ – Excellent

If your credit score is poor and you have been denied for loan, then you can choose to do one of these things-

Improve Your Credit Score

- Pay credit card bills and loans on time

- Settle down past credit defaults

- Increase your credit card limit

- Avoid being a guarantor to anyone

- Get errors in your credit report corrected immediately

- Don’t make unnecessary loan enquiries

- Don’t overutilize your credit limit

Try One of these Options to Get a Loan Approved

If you have a low credit score and need loan urgently, then you can try one of the below given options:

Seek Loan from NBFCs

NBFCs refers to Non-Banking Financial Institutions. They do not have a banking license but they provide loans. As compared to banks, NBFCs are flexible with credit score but charge higher interest rates.

Peer to Peer Lending

For the individuals with a low credit score Peer to Peer Lending may be a good option. These institutions provide loans of small amount with or without any collateral but the rate of interest is really very high.

Apply with a Co-Applicant or Guarantor

If you are married and your spouse is working and have a good credit score too, then you can apply for a loan along with your spouse. It will improve the chances of getting your loan approved many times. On the flip side, if you fail to make time payment of EMIs, then the credit score of both of you will plummet.

These are some of options that you can consider if you have a low credit score and badly need funds. However, you should always try to maintain a good credit score to get your loan approved easily in times of need.

Show Your Lender that Your Income Support EMIs

If you have recently got any salary appraisal or you have some extra source of income, then it increases your chance of getting your loan approved even of you have a low CIBIL or credit score. Just make your lender trust that your income can support your EMIs. However, in such a scenario, you may have to pay a higher rate of interest.

By taking these measures, you may get a personal loan with a low credit score. However, it is essential to make sure that you have sufficient funds to make time repayments. If you fail to make timely repayment of your loan, then it can further impact your credit score negatively. To ensure, your income can support your EMIs, you can use a personal loan EMI calculator online.