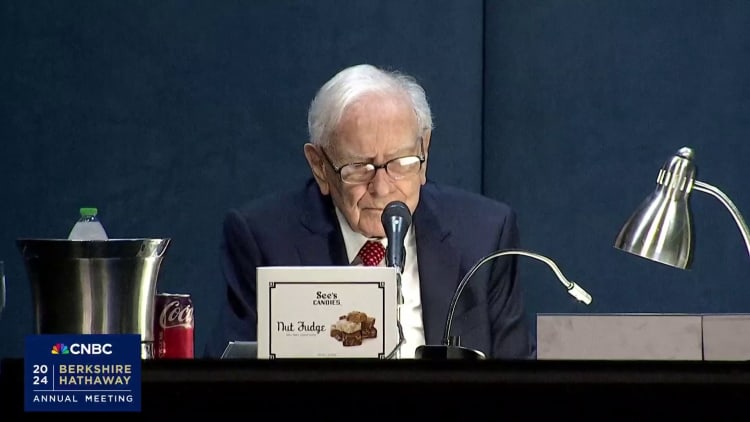

Warren Buffett, known as the Oracle of Omaha, is one of the most successful investors in history. His investment philosophy focuses on value investing, seeking companies with strong fundamentals and predictable earnings.

In 2024, however, Buffett appears to be steering away from artificial intelligence (AI) stocks, prompting many to question the rationale behind this decision.

Buffett’s Investment Philosophy

Buffett’s investment strategy has always emphasized the importance of understanding the businesses behind the stocks.

He prefers investing in companies with strong management teams, sustainable competitive advantages, and predictable revenue streams. This conservative approach has allowed him to navigate market fluctuations and achieve consistent long-term returns.

Reasons for Avoiding AI Stocks

- Uncertainty and Volatility: The AI market is characterized by rapid advancements and high volatility. Many AI companies are startups or emerging players, making it challenging to predict their long-term viability. Buffett tends to avoid investments that carry significant uncertainty, opting for more established companies with proven track records.

- Ethical Concerns: AI technologies raise ethical questions, particularly regarding data privacy and job displacement. Buffett is known for his emphasis on ethical business practices. If he perceives that certain AI companies may face regulatory hurdles or public backlash, he may choose to distance himself from those investments.

- Preference for Traditional Industries: Buffett has historically favored investments in traditional industries, such as consumer goods, financial services, and energy. He tends to invest in companies that have stood the test of time and have a strong market presence. While AI is undoubtedly transformative, Buffett may prefer to wait until it becomes more integrated into established sectors.

- Long-Term Stability vs. Short-Term Gains: AI stocks may promise significant short-term gains, but their long-term stability is uncertain. Buffett’s investment philosophy prioritizes companies that can deliver consistent returns over time. If he believes that AI stocks do not fit this criterion, he may choose to avoid them altogether.

Conclusion

Warren Buffett’s decision to steer away from AI stocks in 2024 reflects his conservative investment philosophy and preference for established companies with predictable earnings.

While AI holds immense potential for innovation and growth, Buffett’s cautious approach highlights the risks and uncertainties associated with the rapidly evolving AI landscape.

Investors should take note of Buffett’s stance and consider their risk tolerance and investment strategy. While transformative AI stocks may offer lucrative opportunities, they come with inherent volatility and unpredictability.

Understanding the reasoning behind Buffett’s investment choices can provide valuable insights for investors navigating the complexities of the stock market.