When filing GST returns, it is important to make sure the file is accurate and is submitted on time. The deadlines for filing are different for different types of businesses. In this article, you will learn about the different types of GST returns filing and how to enter them in MIBook India.

Types of GST Returns and How to Enter Them in MIBook India:-

GST Return Filing in Bangalore:

The deadline for filing GST Return Filing in Bangalore is 120 days. There are several ways to file returns online. One way is to use a digital signature. The digital signature can be obtained via the Electronic Verification Code (EVC), Aadhaar OTP, or an electronic signature certificate. Another option is to mail your returns to the jurisdictional income office in Bangalore. You can also take MIBook services for GST Filing in Bangalore.

It is important to submit your tax returns within the given time. The Income Tax Department allows you to file your ITR-V within 120 days, but they may extend the deadline. Once you have filed your tax returns, you will be required to send an ITR-V acknowledgment, which must be signed and sent to the CPC in Bangalore. Do not send it by registered post, courier, or speed post. If it is rejected, you will be notified by email.

The deadline for filing ITR Filing in Bangalore has been extended once again. The extension was necessary due to problems with Covid 19 and its consequences. Earlier, the due date for filing income tax returns was July 31. Then, the deadline was extended again until October 31. While this may be a bit late for some, the extension will help many taxpayers file their returns.

In addition to extensions, there are some penalties for not filing your tax returns on time. You could face penalties and missing special government benefits if you miss the filing deadline. In this situation, it is best to hire a tax professional who can help you with the process. When the due date of filing the tax return approaches, you will have to pay a fine or interest rate of 1% per month.

Importance of GST Filing for your Business:

There are a number of important deadlines for filing taxes. For instance, if you want to file your annual tax returns in Bangalore, you will have to file them by the 15th day of the fourth month following the end of your taxable year. You must pay quarterly installments as well, and you must pay them within 60 days. There are also some additional deadlines for filing your annual return. The deadlines vary from year to year.

If you need to file more than one ITR, make sure you submit all relevant Form 16s. You may be entitled to a tax refund if your previous employer had deducted taxes for you. You can also claim deductions under section 80G, which applies to donations to nonprofit organizations. Also, if you have a savings account with interest earning up to Rs 10,000, you can deduct the interest you earned there.

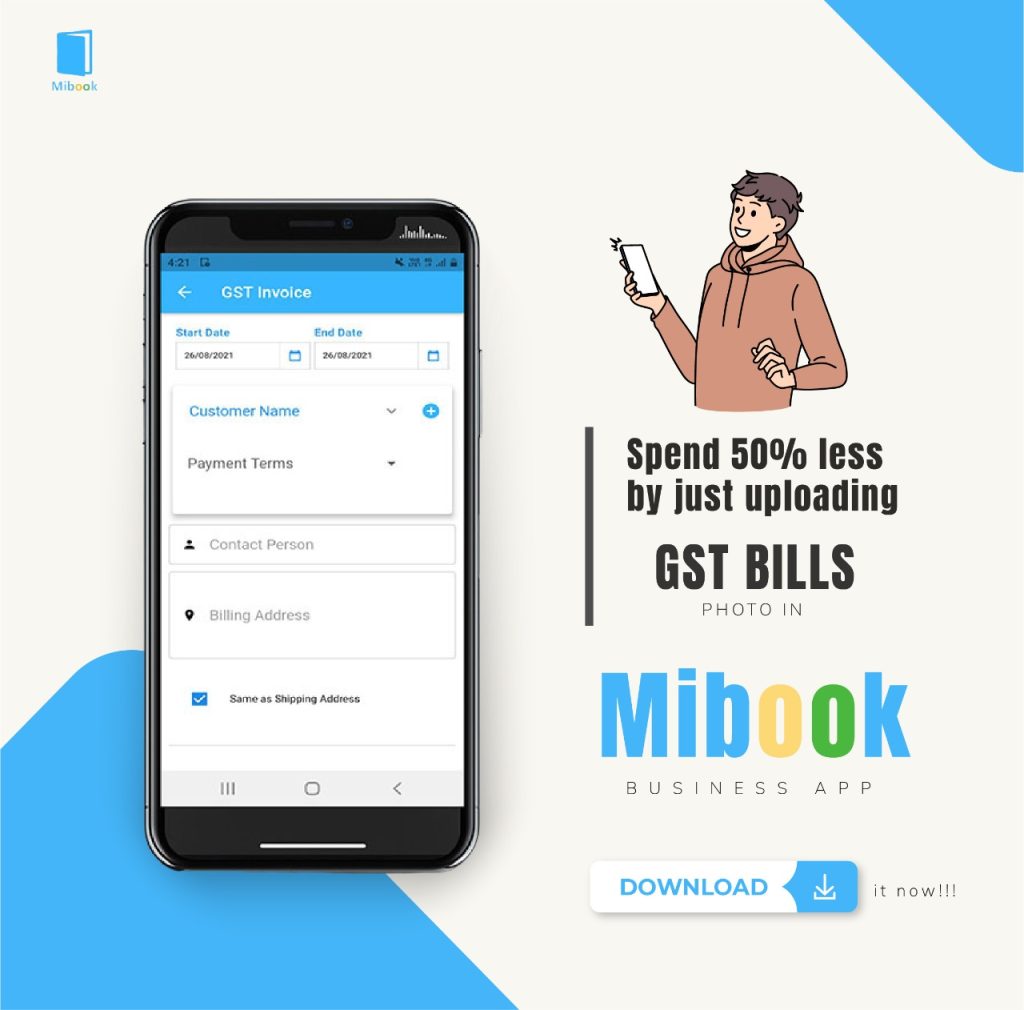

You can file your tax return in 3 minutes using the MIBook Small Business Accounting App. This software was designed by in-house tax experts and is updated regularly. Whether you have to file for your business or an individual, you can file your tax return in under 3 minutes.

Types of GST Returns to be Filed by Different Kinds of Businesses:

There are two main types of GST returns to be filed by different kinds of businesses. The first is the GSTR-1, which contains invoices, debit-credit notes, and related information for the previous month. Both the normal taxpayers and casual taxpayers must file this form. Suppliers and sellers must also report any amendments to sales invoices in this form.

The information contained in the GST return includes the sales, purchases, and expenses made by the business. The tax authorities use this information to calculate the net tax liability. Filing the GST return is required from all businesses registered under the GST regime. Some businesses are required to file it monthly, while others have to file it quarterly or yearly.

Filing GST returns is simple, but it is important to follow the guidelines carefully. Each form must include certain information. You must enter your state code and permanent account number. If you’re unsure, you can always use the GST calculator to make sure you know how much GST you owe.

The GST returns must also reflect the information of taxable supplies. If you are an e-commerce operator, you must file the GST return form with the details of the supplies you make to registered and unregistered customers. You must also include information regarding the amount of tax collected at source and any late payment interest.

GST Return Filing Process:

There are 13 different types of GST returns that need to be filed by different kinds of businesses. The number of returns you need to file depends on the type of business you have and your annual turnover. For example, a business owner with an annual turnover of Rs5 crore will need to file two monthly returns and one annual return. This means he or she will have to file 25-GST returns in a year. Meanwhile, a trader with a yearly turnover of Rs1.5 corer must opt for the composition scheme in order to submit the required number of GST returns.

The annual GST return is mandatory for all taxpayers registered under the GST law. This form combines all other monthly and quarterly GST returns and includes SGST, CGST, and HSN codes. Composition taxpayers don’t have to file GSTR-9A.

The GSTR-1 form is required to be filed by the 28th day of the month following the period in which the statement was filed. It contains the name and address of the taxpayer and the GSTIN. In some cases, it also contains information regarding revisions to outward sales invoices for a previous tax period.

Whether or not the taxpayer uses a combination of paper, or digital filing, GST returns are necessary. It is important to keep all details of the transaction on file in order to ensure smooth credit flow.

How to Enter GST registration details in MIBook India:

When using the Accounting App for your business, you must have GST registration details. You can get this information from your vendor master record. You can access this record from the SAP Easy Access screen. Select the Logistics Materials Management Purchasing Master Data Vendor Central option and then click on the Control checkbox. Look for the Tax Number 3 field. Then, select the GST item code and GST group code.

GST registration is mandatory for businesses that are engaged in providing taxable goods and services in India. Generally, a business must register if the taxable supplies exceed INR 2 million or INR 1 million. Businesses that fall below these thresholds can also register voluntarily. Once the registration process is completed, the registration should be valid in about 3 working days. However, the government may backdate your application by 30 days.

When you file your ITR online, you will be provided with an ITR form in Excel and Java. You should have the software to open this file, but if you do not have it, you can use the e-return intermediary’s software. The software has the necessary functions to complete your ITR, but it is best to consult a chartered accountant.